Download the Whitepaper for In-Depth Analysis and Strategic Investment Opportunities

The New Era of Defense Investment

- A recent paper from Lennertz & Co. explores the USD 3 trillion opportunity for investors—and the events that led to the sector’s historic rise. The purpose of this whitepaper is to provide qualified investors, family offices, and institutional investors with access to an in-depth analysis on the defense sector.

- In an environment marked by heightened geopolitical uncertainty and rapid technological evolution, investors face significant challenges in identifying credible opportunities and mitigating risk. This whitepaper delivers reliable, data-driven intelligence through comprehensive analysis, sector-specific trends, and actionable strategies.

- As spending rises, so do investment opportunities in the sector, with substantial room for capital influx from private investors. The whitepaper empowers decision-makers to navigate complexity, and capitalize on emerging prospects.

A Guide to the $3 Trillion Global Defense Market

Why Defense Sector Investments Are the Next Frontier for Private Equity.

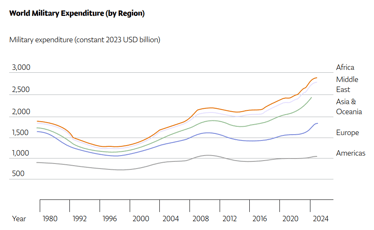

Unprecedented Growth in Defense Budgets

According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure reached $2.72 trillion in 2024, with no signs of a decline.

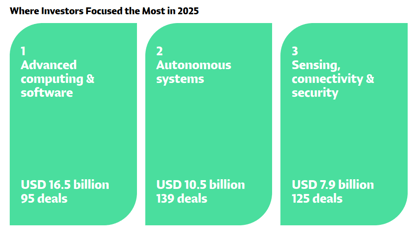

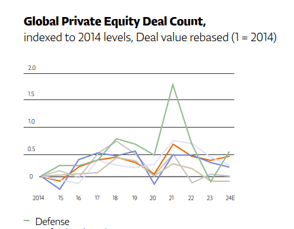

Private Capital's Expanding Role in Defense Innovation

The defense sector has transformed from a traditionally government-dominated industry to one increasingly powered by private investment.

Strategic Investment Approaches for Wealth Managers

For wealth management professionals and alternative investment specialists, the defense sector offers multiple entry points, from direct equity to fund-of-funds structures (FoF).

.png?width=1920&height=1080&name=Untitled%20design%20(1).png)

Opportunities for Private Equity Portfolio Managers

A Uniquely Positioned Asset Class

- The global pivot toward higher defense spending—driven by geopolitical shifts and technological innovation—has opened a robust pipeline of investment opportunities.

- For high-net-worth investors and family offices seeking diversification and growth, the defense-tech ecosystem offers a unique blend of long-duration demand, government partnerships, and cutting-edge innovation.

- There has never been a better time to invest in defense than now. Access the full whitepaper for comprehensive analysis and actionable insights.

What topics are covered in the whitepaper?

The whitepaper provides comprehensive analysis of current market dynamics in the defense sector, including investment trends, sector drivers, risk factors, and strategic opportunities relevant to institutional and sophisticated investors.

Who should download this whitepaper?

The content is tailored for qualified investors, family offices, wealth managers, and decision-makers seeking in-depth, data-driven insights into the defense investment landscape.

How is the information in the whitepaper sourced and verified?

All research and analysis are based on reputable industry reports, regulatory disclosures, market data, and proprietary insights. The information is thoroughly reviewed and verified by experienced professionals in accordance with industry best practices.

This report is neither an offer nor a recommendation to buy or sell financial instruments or assets, or shares of a specific fund. The information contained herein is sourced from what we deem reliable and received in good faith. However, we do not assume any liability or provide a guarantee regarding the timeliness, accuracy, completeness, economic viability, or suitability for a particular purpose of the information contained in this document. The information in this report is based on the knowledge available at the time of the creation of this document. The information may be incomplete and subject to change.

Furthermore, the information and estimates contained herein do not serve the purpose of investment, legal, or tax advice. They do not replace individual investment advice. These are marketing materials, and therefore, the information is exclusively intended for informational purposes. All the information contained herein is to be treated confidentially and may not be disclosed, reproduced, or shared with third parties without prior approval. The product is exclusively aimed at professional and semi-professional investors as defined by the Capital Investment Code (KAGB) and is not intended for private investors.

This publication is protected by copyright. The use of citations or graphics is legally permissible with explicit reference to the external authorship (source reference in accordance with Section 63 of the German Copyright Act). Copyright violations will be prosecuted.

Is there a cost or registration required to access the whitepaper?

The whitepaper is available at no cost. Registration with valid contact information is required to access the download.

How will my contact information be used? (Data Privacy)

Your information will be used solely to fulfill your request and to provide relevant updates on investment opportunities. All data is handled in accordance with applicable data protection regulations and our firm's privacy policy.

Imprint

Information according to § 5 TMG:

Lennertz & Co. Capital GmbH

Düsternstraße 10

20355 Hamburg

Germany

Represented by:

Philipp Lennertz, Christian Piper

Contact:

Tel: +49 40 210 91 33-20

Email: info@lennertz.com

Register entry:

Office: Hamburg

Register number: HRB 176714

Supervisory authority:

Bundesanstalt für Finanzdienstleistungsaufsicht (Federal Financial Supervisory Authority)

Marie-Curie-Str. 24-28

60439 Frankfurt

Germany